How to use the terminal. Margin trading.

To start operations in the trading terminal (margin), you need to open a trading account in RUB or USD. The account can be opened and topped up in personal account.

Margin is trading cryptocurrency with leverage (from 1 to 20).

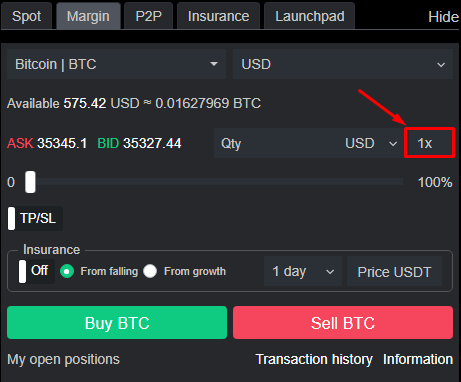

To start trading, select a trading account and a cryptocurrency.

The available balance is displayed both in the currency of the trading account and the equivalent in the selected cryptocurrency.

Bid and ask prices. Bid is the price at which the cryptocurrency will be sold. The green color means that these are applications for the purchase of cryptocurrencies.Ask is the price at which the cryptocurrency will be purchased. The red color means that these are applications for the sale of cryptocurrencies. In order not to get confused, example: when you buy, you need a seller to buy from him (ask), when you sell, you need a buyer to sell to him (bid).

The position size (number) can be specified both in the currency of the trading account and in the amount of the cryptocurrency itself. Also, it is possible to specify the amount as a percentage of the available balance.

You can open positions to buy (earn on the growth of cryptocurrencies) and sell (earn on the fall of cryptocurrencies).Leverage - it is possible to open a position for a volume greater than the available balance. This means that with $100, using leverage 5, you can open a position for $ 500. The position in this case will be reflected as 100 x5. Your risk will be limited only by your balance. But, the possibility of earning will grow in multiples of the selected shoulder.

To choose the leverage you need, click on the icon labeled 1x.

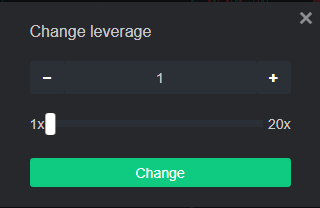

Afterwards, choose the leverage that suits your needs

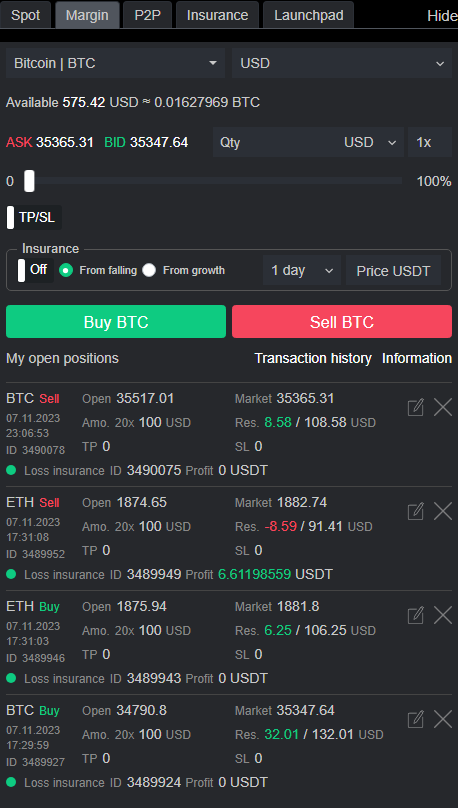

TP/SL is the take profit and stop loss of your position. To close a position or change tp/sl, use the functionality for each open position.

It is possible to have both the purchase and sale of the same cryptocurrency at the same time.

In operation history you can see all the operations performed.

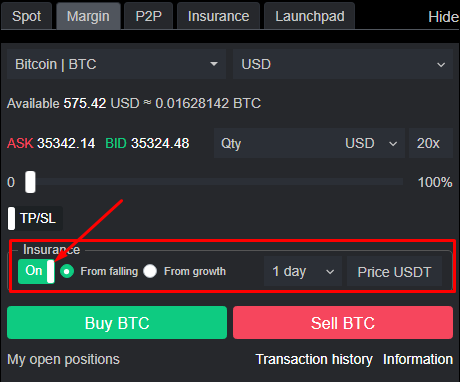

Insurance for opened positions.

When opening a position, you have the option to insure your trade against unforeseen sharp market fluctuations.

To insure your position, you need to activate insurance at the time of opening the position.

Afterward, select the desired insurance period. The insurance cost depends on various factors, including market volatility and the insurance term. After specifying all the parameters, you will receive the insurance cost.

For more detailed information about how insurance works, you can read in the insurance terminal.